Given the number of flight cancellations, lost bags, and lingering Covid issues that hampered the travel industry following the pandemic, it's not surprising that many tourists may be thinking of adding travel insurance to their travel costs.

This post contains affiliate links, and I may earn compensation when you click on the links at no additional cost to you.

This post contains affiliate links, and I may earn compensation when you click on the links at no additional cost to you.

But while it seems like a necessity in this day and age, consumers are often puzzled by what travel insurance actually covers and also by the sheer number of insurance policies to choose from.

Ireland on a Budget took the time to talk to travel insurance expert Chelsea Capwell of the travel insurance online aggregator Travel Insurance Master to get some answers to the kinds of questions that many people have about searching for and choosing a travel insurance plan.

Travel Insurance Master makes it easier than ever to find the best travel insurance plan for your next trip and compare the top providers and their plans all on one website.

The team at Travel Insurance Master has been in the industry for decades and has partnered specifically with the best travel insurance companies they personally have experience with, explains Capwell.

“What makes Travel Insurance Master different is that their unique, trusted smart algorithm will recommend the best plan for you in just a few simple steps,” she says.

“With a number of providers and a large variety of plans and benefits, you know you’re finding the best plan and value versus a one-size-fits-all alternative which may not have the coverage you need.”

- Book the best tours and guides on TripAdvisor, Viator or GetYourGuide

- Get reliable travel insurance with Travel Insurance Master

- Get the best flight tickets with Avisales

- Rent a comfortable car via Discover Cars

- Find the best accommodation on Booking.com or BandBIreland

Can you explain travel insurance coverage and why it's important to consider it?

Travel insurance protects you and your trip from the unexpected and gives you the ultimate peace of mind.

Normally your vacations and trips are things you invest time and money into.

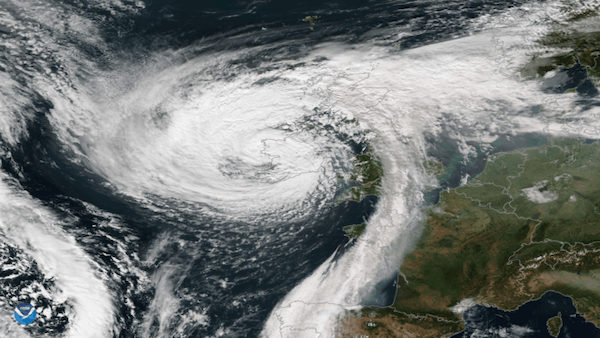

Adverse weather, illness, and more could easily interrupt or cancel your trip so it’s important to protect that investment.

Did you know travel insurance may reimburse 100% of your trip cost (your prepaid and non-refundable trip expenses) if you or your travel companion become sick or injured and cannot travel?

Travel insurance is truly an invaluable piece of any trip that takes you 100 miles or more from home, including domestic trips and road trips too!

There are two main types of travel insurance you’ll be able to filter for on TravelInsuranceMaster.com.

The first type is Trip Cancellation or Comprehensive Plans.

These plans combine Trip Cancellation with travel medical options, offering the most coverage.

Trip Cancellation gives you the ability to cancel your trip before it starts to receive reimbursement of 100% of your trip cost.

There are many covered reasons for trip cancellation, most commonly when sudden illness or injury prevents you from taking a trip.

If there is little time before your trip and the chance of it being canceled is slim, or your trip is so important that cancellation is not an option, filter by No Trip Cancellation on the Plan Results Page.

These Limited Plans without Trip Cancellation are a fraction of the Comprehensive Plan cost.

The Travel Medical Plans will provide medical coverage primarily but not exclusively outside your home country.

Many travelers do not realize that their regular health insurance provides very little or no coverage while they’re abroad and travel insurance can fill that gap in coverage.

Read More: Planning a Trip to Ireland A to Z

Are you seeing an increase in travel insurance queries since Covid-19 given that more people are aware of the health risks when traveling?

Absolutely! I think a lot of travelers who hadn’t purchased travel insurance before are now opting for it because they see just how valuable it is.

For a relatively small fraction of their travel budget, they can protect their trip with coverage that not only covers Covid-19, but also other unexpected things like hurricanes, employment layoffs, and a ton of others you may not necessarily think of — just like we could have never imagined the pandemic prior to 2020.

It's important to note that travel insurance treats Covid-19 the same as any other illness.

All of our “Trip Cancellation” plans cover trip cancellation or interruption if you get sick or test positive for Covid-19.

Visit our Covid-19 FAQ page located at the bottom of the Travel Insurance Master website to see exactly how different benefits protect you in different scenarios like if you test positive before your trip, or during your trip!

Become familiar with your Plan Details for requirements you will need to meet like proof of cancellation, coverage limits, and more specific information.

Get Wifi While Traveling Across Ireland with Wifi Candy – take 10% off with coupon code IOB2024

Some people feel that their regular health insurance policy or the travel insurance on their credit card is enough to provide them with coverage if they get into serious health trouble when abroad. What would you say about that?

A lot of travelers do not realize until it’s too late that their regular health insurance provides little to no coverage when traveling abroad. Without travel insurance, you could be left paying out of pocket or even up front for emergency medical care!

With credit cards, you normally get very minimal if any travel protection.

It’s important to always review your cardholder agreement as the benefits usually don’t cover much.

Credit cards normally protect against small inconveniences like lost luggage. Medical repatriation and pre-existing conditions are generally not covered.

A standalone plan like one from TravelInsuranceMaster.com may include these and a wide variety of valuable benefits. You can even utilize our customizable filters to find a plan with the exact benefits you’re looking for.

If you or someone you are buying travel insurance for has a pre-existing health condition, you will definitely want to look into a stand-alone travel insurance policy.

Could the health condition flare up or reoccur before or during your trip? Could it cancel or interrupt your travels?

For plans without the Pre-existing Medical Conditions waiver, normally a medical condition present prior to your plan's effective date would not be covered.

Most plans have a look-back period meaning the plan investigates your medical history, anywhere from 2 to 18 months back, to see if your condition appeared or was treated during that time.

Comprehensive plans with a Pre-existing Medical Conditions Waiver will give you coverage if you buy your plan the same day or within a set number of dates after your initial trip deposit.

If you didn’t purchase your travel insurance that early, look for a plan with a look-back period shorter than when you last registered your health condition with your doctor.

Since there are lots of travel insurance providers out there, how does Travel Insurance Master differ from them, and also, how does it help travelers select the right insurance plan for their specific needs?

TravelInsuranceMaster.com, as mentioned above, is an online aggregator that utilizes our very own smart algorithm to recommend the best insurance plan and value for you and your trip!

Our team has worked in the travel industry for decades so we have partnered with a number of the top providers we know and trust to bring a large variety of plans and benefits all to one website.

Whereas many travel insurance companies only offer a one-size-fits-all plan, and you then have to jump from website to website to shop and compare, we’re able to bring the leading travel insurance providers together so you can easily compare plans and make an educated purchase.

When you request a quote at TravelInsuranceMaster.com, you’ll quickly find your very own recommended plan and clear side-by-side comparisons of similar ones.

Plus, you’re backed by two layers of customer service – one with your provider and one with the Travel Insurance Master team.

If readers of Ireland on a Budget are interested in securing travel insurance with Travel Insurance Master, what are the steps they should take on your website to do that?

Head to TravelInsuranceMaster.com to request a quote in just a few simple steps by inputting your trip and traveler details, even if you haven’t paid for your trip in full yet.

You’ll quickly find your recommended plan, and similar plans to shop and compare. You can utilize the filters to narrow plans down by the benefits most important to you and appropriate for your itinerary. Once you have selected a plan, complete your purchase, and you’ll receive it straight to your email!

How far in advance should someone purchase travel insurance and if travel has already commenced, can insurance be purchased during a trip?

The best time to buy travel insurance is within 1 – 21 days (depending on the insurance company) of making your first deposit on your trip!

It’s best to shop for and purchase travel insurance early as there are time-sensitive benefits that make purchasing early worthwhile. You can buy insurance even if you have not paid for your trip in full yet.

If you buy insurance within the stated timeframe from the initial deposit, usually 2 weeks, you will get broader coverage like the Pre-existing Medical Conditions waiver and more, depending on the specific plan.

If you’re looking for the Cancel for Any Reason (CFAR) benefit, you will normally need to buy insurance within 1-21 days of the initial deposit, depending on the specific plan.

The earlier you buy insurance after booking your trip the better, but some plans do allow you to buy coverage up until the day before you leave.

However, just like you couldn’t buy car insurance after an accident, you cannot purchase travel insurance once you’ve started your trip.

What is the average cost of travel insurance?

The average trip is $3000 and the travel insurance plan for that amount is generally speaking $100-$300, depending on coverages.

With COVID-19, travelers are electing for more coverages though, like CFAR (Cancel for Any Reason), which is the costliest but gives the most flexibility!

Is the process of filing a claim with Travel Insurance Master easy?

With Travel Insurance Master, you get two layers of customer service – one through your provider and one through us!

Every claims situation is going to be different, and there are a few differences in how you will need to respond to them.

Please keep in mind that if an emergency arises, contact your insurance company as soon as reasonably possible!

Each policy includes a claims phone number and 24-hour assistance phone numbers for both inside and outside of the United States, ensuring that you can get in touch with your insurer at any time.

If you are traveling internationally, you will need to make a collect call with the out-of-country emergency number.

Visit the Travel Insurance Master Filing a Claim page and find your provider for your specific claims information. Travel Insurance Master customers also have the option to have their claims reviewed by our customer care team.

Would you consider purchasing travel insurance? Let me know in the comments below.